Thread Reader helps you read and share Twitter threads easily!

I'm @ThreadReaderApp a Twitter bot here to help you read threads more easily. To trigger me, you just have to reply to (or quote) any tweet of the thread you want to unroll and mention me with the "unroll" keyword and I'll send you a link back on Twitter 😀

— Thread Reader App (@threadreaderapp) November 25, 2017

X thread is series of posts by the same author connected with a line!

From any post in the thread, mention us with a keyword "unroll"

@threadreaderapp unroll

Follow @ThreadReaderApp to mention us easily!

Practice here first or read more on our help page!

Recent

Mar 9

Read 13 tweets

The very serious situation in 🇧🇷, a 🧵.

1/ Mr. Trump @POTUS is set to designate 🇧🇷 ‘s PCC (First Capital Command) and Comando Vermelho (Red Command) as Foreign #Terrorist Organizations. A massive move.

1/ Mr. Trump @POTUS is set to designate 🇧🇷 ‘s PCC (First Capital Command) and Comando Vermelho (Red Command) as Foreign #Terrorist Organizations. A massive move.

2/ This designation allows the US to freeze global assets and target the financial networks of these #brutal #cartels directly.

3/ The caviar #socialist is reportedly furious, claiming it violates "sovereignty." Critics ( and I agree a hundred percent) say he's just terrified of US eyes on 🇧🇷’s internal #corruption.

Mar 9

Read 7 tweets

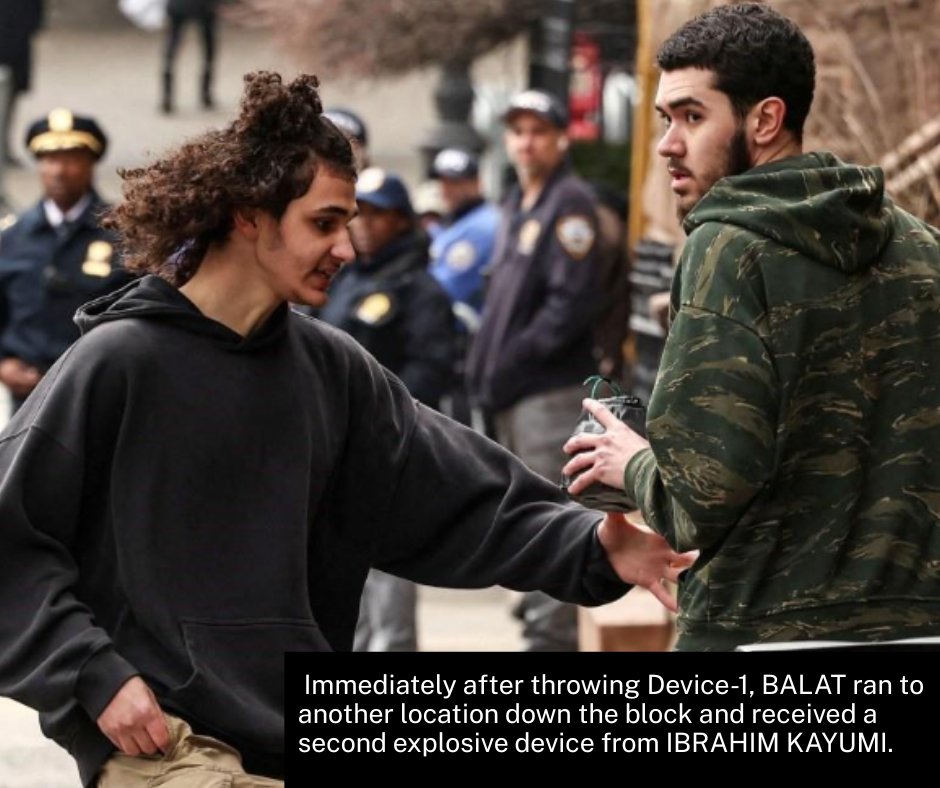

🚨TWO ISIS SUPPORTERS CHARGED WITH ATTEMPTING TO DETONATE EXPLOSIVE DEVICES DURING PROTESTS OUTSIDE GRACIE MANSION

Avowed ISIS supporters Emir Balat and Ibrahim Kayumi attempted to detonate two devices containing shrapnel and highly volatile explosive material during a protest and counter-protest outside the Mayor of New York's residence.

Great work @SDNYnews @NYPDnews @FBINewYork!

🔗: justice.gov/opa/pr/two-isi…

Avowed ISIS supporters Emir Balat and Ibrahim Kayumi attempted to detonate two devices containing shrapnel and highly volatile explosive material during a protest and counter-protest outside the Mayor of New York's residence.

Great work @SDNYnews @NYPDnews @FBINewYork!

🔗: justice.gov/opa/pr/two-isi…

Mar 9

Read 4 tweets

The problem with this thought is the Iranian drones being fired now are the uber sophisticated Russian-guilt Geran using radio mesh and cell phone sim card link video-navigation.

1/3

1/3

They are flying lower and more sophisticated trajectories taking advantage of radar shadows from oil infrastructure in the Gulf to prevent the generation of good intercept tracks.

Gun armed ships and attack helicopters low amongst oil rigs are the best play here.

2/3

Gun armed ships and attack helicopters low amongst oil rigs are the best play here.

2/3

It is only a matter of time until Geran/Shaheed FPV motherships are being fired by the IRGC at Gulf Oil infrastructure using Gulf Cell phone networks as video data links.

3/3

3/3

Mar 9

Read 8 tweets

1/ Trump’s year of tariffs produced a new high... for whom?

2/ 2025 was the year in which President Trump declared tariff war on adversaries and allies alike. This began with what he named “Liberation Day” on April 2nd and continued with fits and starts thereafter.

3/ Last month after the Supreme Court declared Trump lacked the legal authority to wave his IEEPA tariff wand in the way he had, Trump and his team responded by asserting tariff authority under alternative statutes and imposing a 15% tariff on most items.

Mar 9

Read 3 tweets

Mar 9

Read 4 tweets

This messaging is in odd contrast to what we're seeing on the ground. I think they're realizing that the backlash from this is already immense, and will not heal--it might only be forestalled for awhile.

We all know who wanted this.

We all know who wanted this.

To Americans that believe the Epstein "lone wolf" narrative, "Israel" is no longer just an "over there" problem for the Gazans--their evil affects us over here. The gas prices show it now--when the real costs of this brief war are uncovered, it will get worse.

Mar 9

Read 5 tweets

Introducing Code Review, a new feature for Claude Code.

When a PR opens, Claude dispatches a team of agents to hunt for bugs.

When a PR opens, Claude dispatches a team of agents to hunt for bugs.

Agents search for bugs in parallel, verify each bug to reduce false positives, and rank bugs by severity.

You get one high-signal summary comment plus inline flags.

You get one high-signal summary comment plus inline flags.

We've been running this on most PRs at Anthropic. Results after months of testing:

PRs w/ substantive review comments went from 16% → 54%

<1% of review findings are marked incorrect by engineers

On large PRs (1,000+ lines), 84% surface findings, avg 7.5 issues each

PRs w/ substantive review comments went from 16% → 54%

<1% of review findings are marked incorrect by engineers

On large PRs (1,000+ lines), 84% surface findings, avg 7.5 issues each

Mar 9

Read 3 tweets

NEW—In a phone interview, President Trump told me the war could be over soon: “I think the war is very complete, pretty much. They have no navy, no communications, they’ve got no Air Force.” He added that the U.S. is “very far” ahead of his initial 4-5 week estimated time frame.

Asked about Iran’s new Supreme leader Mojtaba Khamenei, who Trump has openly criticized, he said, “I have no message for him. None, whatsoever.” Trump said he has someone in mind to replace Khamenei, but he did not elaborate.

As for the Straight of Hormuz, Trump noted that ships are moving through now, but he is “thinking about taking it over.”

Trump warned Iran, “They’ve shot everything they have to shoot, and they better not try anything cute or it’s going to be the end of that country.”

Trump warned Iran, “They’ve shot everything they have to shoot, and they better not try anything cute or it’s going to be the end of that country.”

Mar 9

Read 4 tweets

NEW: President Trump has told aides he would back the killing of new Iranian Supreme Leader Mojtaba Khamenei if he proves unwilling to cede to U.S. demands, such as ending Iran’s nuclear development, current and former U.S. officials said.

The White House declined to comment, but Trump on Monday told the New York Post he was “not happy” that Khamenei was selected to lead Iran. He called young Khamenei "unacceptable."

“I’m not going through this to end up with another Khamenei,” Trump told Time magazine last week.

“I’m not going through this to end up with another Khamenei,” Trump told Time magazine last week.

Israel would likely execute an operation aimed at taking out Khamenei, who was named as supreme leader on Sunday, a current and a former U.S. official said, noting that Israel is taking the lead on targeting Iranian leaders.

Mar 9

Read 16 tweets

The Notes app on your iPhone is one of the most powerful tools available.

But 99% of people don’t know its true potential.

Here are 15 amazing features you must know:

But 99% of people don’t know its true potential.

Here are 15 amazing features you must know:

1. Document Scanning

• Long-press on the Notes app until the submenu appears.

• Select "Scan Documents."

• Scan your document and tap save.

• Long-press on the Notes app until the submenu appears.

• Select "Scan Documents."

• Scan your document and tap save.

2. Password-Protect a Note

• Open your note, tap the "..." menu, and choose "Lock."

• Decide whether to use your iPhone’s code or create a custom one (note: forgotten manual codes can’t be recovered).

• Now, Face ID or a code is required to access this note.

• Open your note, tap the "..." menu, and choose "Lock."

• Decide whether to use your iPhone’s code or create a custom one (note: forgotten manual codes can’t be recovered).

• Now, Face ID or a code is required to access this note.

Mar 9

Read 5 tweets

1/ We released NanoGPT Slowrun 10 days ago. Already at 8x data efficiency and improving fast, so we're doubling down.

Announcing Slowrun Research and Slowrun Cluster: our open research effort to collaborate with researchers with crazy ideas, and a serious cluster to back it.

Announcing Slowrun Research and Slowrun Cluster: our open research effort to collaborate with researchers with crazy ideas, and a serious cluster to back it.

2/ Why? Compute scales. Data doesn't. Current scaling laws require both to grow proportionally, and that's a big problem. We need fundamentally new learning algorithms in the limited data, practically infinite compute settings.

Slowrun is already surfacing new data-efficient methods, but we want to aim for at least 100x data efficiency this year and that will take a lot more exploration.

Slowrun is already surfacing new data-efficient methods, but we want to aim for at least 100x data efficiency this year and that will take a lot more exploration.

3/ Some research directions we think are interesting:

a. Replacing gradient descent: SGD was designed for limited compute, unlimited data - precisely the opposite of where we're headed. Alternatives that leverage more compute for broader exploration of the loss landscape become viable in the Slowrun regime. Evolutionary algorithms have been scaled efficiently to billions of parameters and can already surpass backprop, esp in rough optimization landscapes where gradients are noisy. arxiv.org/abs/2511.16652, arxiv.org/abs/2509.24372

b. Diffusion Models: DLMs seem significantly more data-efficient than AR. There are a few reasons to believe this: they use more FLOPs at train and test time via iterative denoising, and they get built-in data augmentation from different corruption patterns per sequence. But they haven't been stress-tested against the kind of improvements Slowrun is finding for AR models. arxiv.org/abs/2511.03276, arxiv.org/pdf/2507.15857

a. Replacing gradient descent: SGD was designed for limited compute, unlimited data - precisely the opposite of where we're headed. Alternatives that leverage more compute for broader exploration of the loss landscape become viable in the Slowrun regime. Evolutionary algorithms have been scaled efficiently to billions of parameters and can already surpass backprop, esp in rough optimization landscapes where gradients are noisy. arxiv.org/abs/2511.16652, arxiv.org/abs/2509.24372

b. Diffusion Models: DLMs seem significantly more data-efficient than AR. There are a few reasons to believe this: they use more FLOPs at train and test time via iterative denoising, and they get built-in data augmentation from different corruption patterns per sequence. But they haven't been stress-tested against the kind of improvements Slowrun is finding for AR models. arxiv.org/abs/2511.03276, arxiv.org/pdf/2507.15857

Mar 9

Read 6 tweets

The Justice Department has released a batch of previously unreleased documents from the Epstein files that include notes from FBI interviews with a woman who says she was assaulted by President Donald Trump as a minor.

According to the summaries of her 2019 FBI interviews, the woman claimed Epstein first abused her repeatedly starting around 1983 after responding to her babysitting ad in Hilton Head Island, South Carolina, when she was approximately 13.